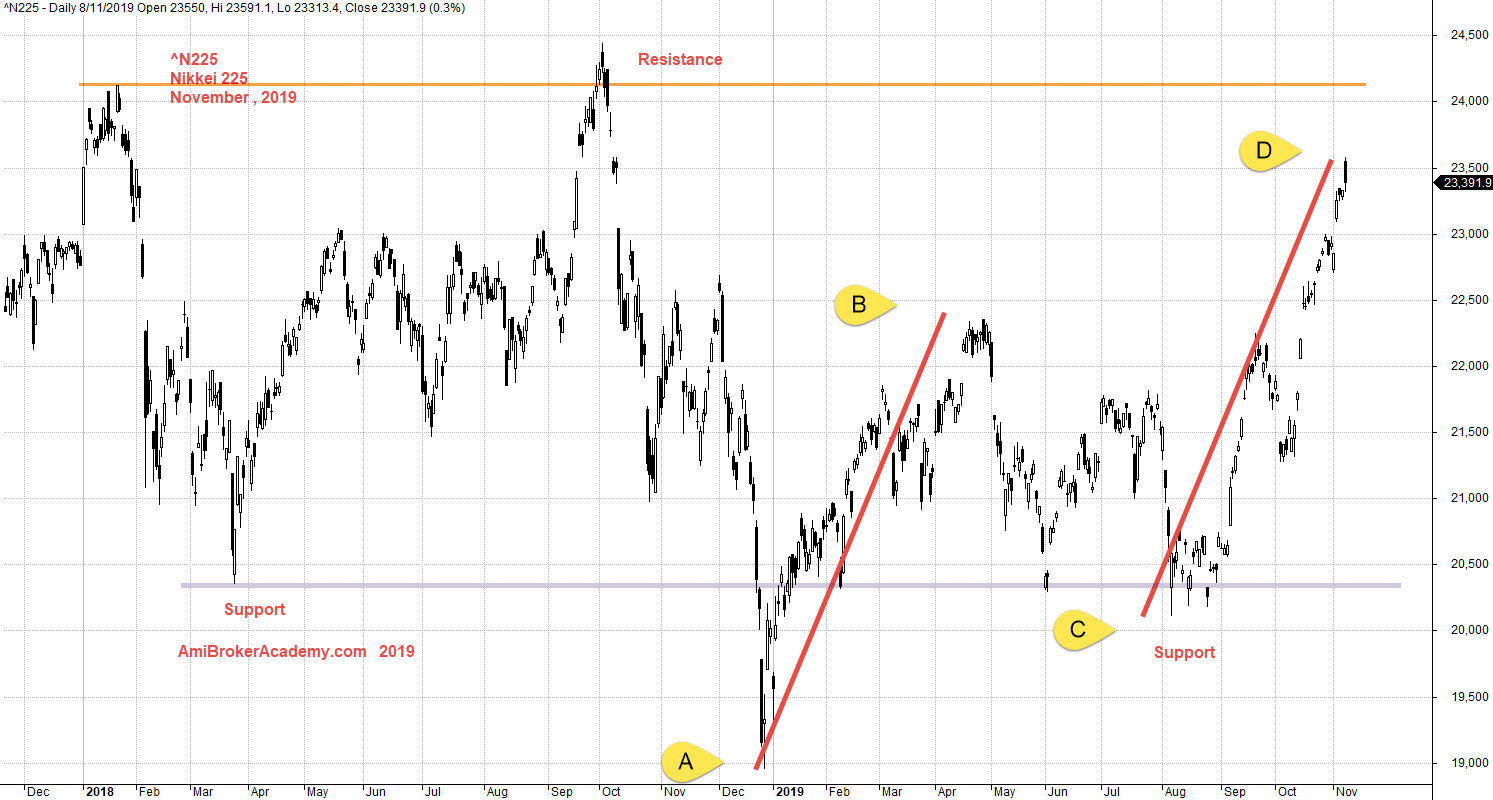

The abcd pattern in trading price should begin to rise from its support at up to a new high. Once support has been established at, you are almost ready to enter a short position. The support should be higher than the initial point. There are 3 types of ABCD patterns in which specific criteria/characteristics must be met. You should still not enter the trade as you are not sure where the bottom of the pullback will be. When the price reaches D, I sell half of my position and bring my stop higher. Trading Station, MetaTrader 4, NinjaTrader and ZuluTrader are four of the forex industry leaders in market connectivity. The ABCD pattern is extremely easy to follow and is great because so many traders still follow it.ĭetermining the best forex platform is largely subjective. It is normally a sign buyers are running out of gas. Point D is generally derived from the first red candle in the 5-minute chart after an uptrend commences. It’s one of the great cat and mouse - or bull and bear - games of all time. When enough traders have the same thesis and make the same move in a short period of time, the pattern plays out. My goal is for you to learn to take losses the right way. You WILL take losses as a trader - it’s part of the game. Similarly, point B should be the 0.618 retracement of drive 2.A good example would be a Chaikin Oscillator, it’s an indicator that shows how much money may be flowing by combining price and volume.Several students report success with midday breakouts.That doesn’t mean you can’t or shouldn’t trade a pattern I don’t trade.The second point D I secured the position, using the red candle in the 5-minute chart as my signal.Monthly What we may be seeing is a positive trendline forming on the monthly and seems to have been A break of the previous low will likely form a double top.A good example would be a Chaikin Oscillator, it’s an indicator that shows how much money may be flowing by combining price and volume. The goal is to enter a profitable trade during a pullback when the price is still close to point C. When not managing his personal portfolio or writing for TradeVeda, Navdeep loves to go outdoors on long hikes. Navdeep has been an avid trader/investor for the last 10 years and loves to share what he has learned about trading and investments here on TradeVeda. The beginning of the pattern starts with a sharp and strong upward price movement. Have some extra money to buy more at the lower levels. It went through a long accumulation phase between the Weekly Resistance of 53sats and Weekly Support of 36sats from December to June this year. Should Enter soon about to blow up soon, 2 target you could grab before retrenchment P 0. I will say this looks pretty interesting This feature will allow us to broadcast in real time and the audience will be able to engage live via chat. They also provide an insight into whether the price is about to change directions. The patterns help traders determine the risks and identify opportunities to turn a profit in any market.

#Abcd pattern stocks how to

Learning how to spot chart patterns in the trading market is a skill most traders aim to develop.

Frequently Asked Questions About Stock Chart Patterns.Which Is The Best Way To Trade The Abcd?.Cambium Learning Group Inc Abcd Stock Price Chart History.

0 kommentar(er)

0 kommentar(er)